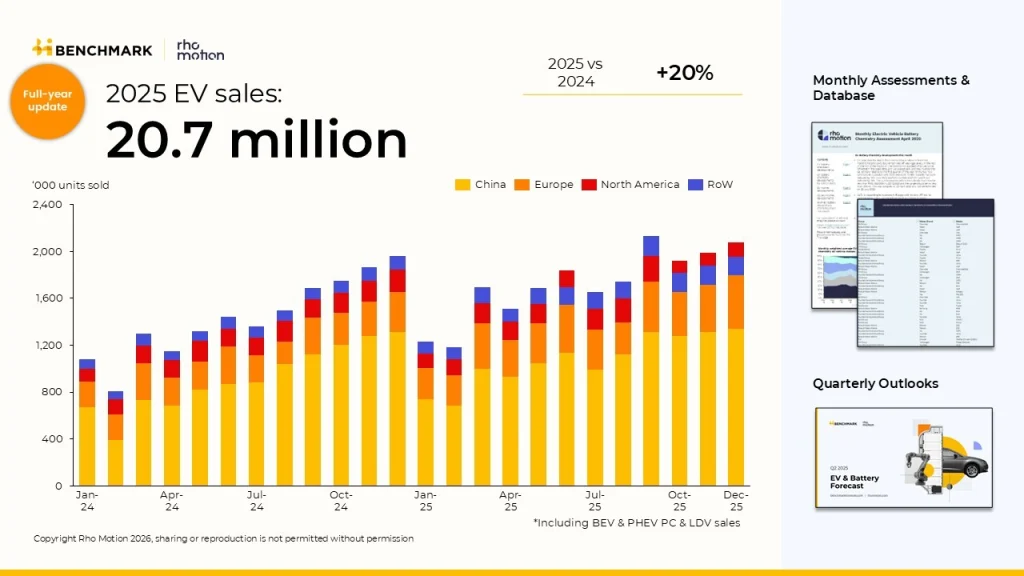

Benchmark Mineral Intelligence reports that global electric vehicle (EV) sales reached 20.7 million units in 2025, a 20% increase over the previous year. In December alone, 2.1 million EVs were sold, capping off a strong year for the passenger car and light-duty vehicle segment. Regionally, China led with 12.9 million units sold (up 17%), followed by Europe at 4.3 million (+33%), North America at 1.8 million (–4%), and the Rest of World at 1.7 million (+48%).

Benchmark’s data manager noted the market’s resilience and rapid transformation over the past year. Europe emerged as the fastest-growing major region, supported by softened EU tailpipe emissions targets and expanded consumer subsidies. Battery electric vehicles (BEVs) accounted for 31% of the region’s growth, while plug-in hybrid electric vehicles (PHEVs) contributed 38%. Germany and the UK led Europe’s volume gains with 48% and 27% growth, respectively, and France finished the year with modest 2% growth after stronger incentives in the final months. Looking ahead, proposed adjustments to the EU’s 2035 emissions targets and renewed consumer subsidies are expected to sustain momentum, with European EV sales projected to grow by about 14% in 2026.

In North America, policy changes including the removal of federal tax credits, reduced emissions fines, and protectionist manufacturing measures led to just a 1% increase in U.S. EV sales and a 41% decline in Canada. Mexico bucked the trend with a 29% rise, driven largely by imports. U.S. EV registrations spiked in late summer ahead of credit expirations, then plunged 49% in the fourth quarter. With limited incentives and weaker regulatory support, U.S. EV sales are forecast to fall by 29% in 2026. Automakers are planning several range-extended electric models, reflecting consumer preferences for larger vehicles and easing reliance on public charging.

China’s market grew by 17%, with BEVs up 26% and PHEVs up 6%. Growth slowed in Q4 as sales were compared against strong mid-2024 subsidy-driven demand. Intensified domestic competition and aggressive pricing spurred manufacturers like BYD to double exports, surpassing one million units and boosting EV uptake across Southeast Asia, South America and Europe. From 2026, EVs in China will face a 50% purchase tax exemption and a new proportional trade-in subsidy, reducing average support levels.

Outside these regions, the Rest of World saw a 48% increase in EV sales, with Southeast Asia and South & Central America benefiting from Chinese imports. Japan’s market grew by just 6% as hybrid EVs remain dominant, while South Korea achieved 50% growth thanks to government incentives and new model launches.

Source: Rhomotion