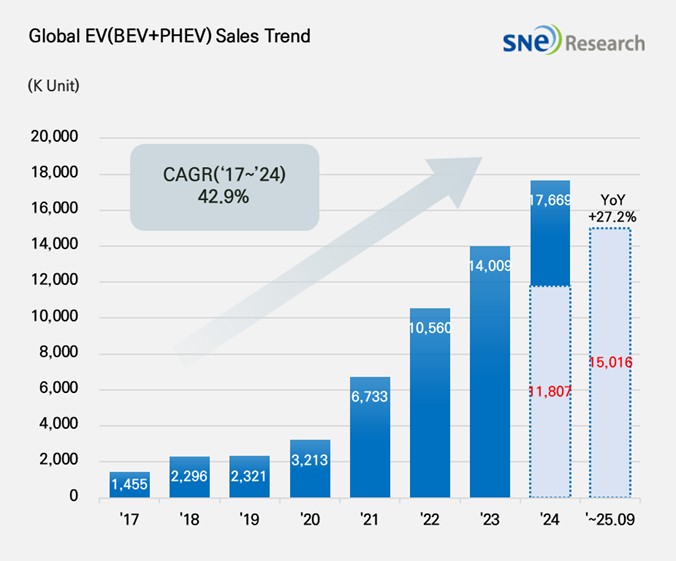

From January through September 2025, global electric vehicle (EV) registrations reached approximately 15.016 million units, representing a 27.2% year-over-year increase from 11.807 million in the same period of 2024, according to SNE Research’s Global EV and Battery Monthly Tracker.

Chinese automaker BYD retained the top position with around 2.961 million units sold, up 10.6% year-over-year. The company has expanded production capacity in Europe (Hungary and Turkey) and Southeast Asia (Thailand, Indonesia, Cambodia) to adapt to shifting tariff and subsidy policies. Leveraging competitive pricing and broadening its lineup—from commercial vehicles to ultra-compact models—BYD recently adjusted its annual sales target to 4.60 million units, down from 5.50 million, reflecting intensifying competition in the Chinese EV market.

Second-place Geely Group posted roughly 1.522 million deliveries, a 64.7% increase. Geely attributes this growth to strong demand for its Star Wish model and its multi-brand strategy—spanning premium ZEEKR, hybrid-focused Galaxy, and global-market LYNK & CO—underpinned by accelerated in-house development of battery systems, electrical components, and software.

Tesla ranked third with 1.218 million sales, a 5.9% decline driven by lower Model 3 and Model Y deliveries. Regional performance varied, with North America up 2.3% to 434,000 units, offset by declines in Europe (198,000 units, down 19.7%) and China (433,000 units, down 6.0%). Ongoing enhancements to its Full Self-Driving software and subscription services are unlikely to boost near-term volumes.

Hyundai Motor Group delivered about 484,000 EVs, a 16.6% rise. Battery-electric vehicle leadership came from IONIQ 5 and EV 3, while demand softened for some existing models. Plug-in hybrid sales reached 83,000 units, supported by Sportage, Tucson, and Sorento variants. Hyundai faces an 8.7% sales decline in North America but is diversifying its portfolio with new models like EV 4 and IONIQ 9 and localizing procurement to manage subsidy and tariff fluctuations.

Regionally, China accounted for 9.471 million units (63% share, +26.7%), Europe saw 2.981 million (19.9% share, +32.2%), North America reached 1.443 million (9.6% share, +9.0%), and the rest of Asia delivered 834,000 units (5.6% share, +50.4%).

While China’s growth is driven by entry-level and commercial EVs, Europe is led by mid-size SUVs on universal platforms and North America faces post–tax credit volatility. Emerging Asian markets focus on affordable, locally produced models. Global OEMs are responding with technology localization, regional supply chains, and cost-efficient offerings to navigate policy uncertainty and profitability pressures.

Source: SNE Research