Welcome back to this week’s Battery Business Insights article. The European battery industry witnessed a pivotal development this week as U.S.-based Lyten announced its acquisition of the remaining assets of the bankrupt Swedish battery maker, Northvolt. This event concludes a dramatic chapter for a European industrial hopeful and begins a new one, placing advanced lithium-sulfur battery technology at the core of major European production facilities.

By the Numbers

- $5 billion: The approximate original value of the acquired Northvolt assets.

- $625+ million: Total investment raised by Lyten following a recent funding round.

- 16 GWh: The operational battery production capacity at the Northvolt Ett facility.

- 7,000: The approximate number of people employed by Northvolt before its bankruptcy.

- 2x: The energy density of Lyten’s lithium-sulfur batteries is more than twice that of conventional lithium-ion cells.

Background: From European Champion to Bankruptcy

Northvolt was established with the goal of becoming Europe’s leading battery manufacturer, a regional champion to compete with established Asian producers. The company successfully secured more than $13 billion in funding and started building a network of facilities, including its main gigafactory, Northvolt Ett, in Sweden. The objective was to create a strong European battery supply chain to support the growing electric vehicle market.

Despite its ambitious start, the company encountered substantial hurdles. Scaling up production proved difficult, and operational targets were missed. Reports pointed to issues with machinery and organizational inefficiencies that affected output. These problems led to increasing financial losses, reaching $1.2 billion in 2023. After failing to secure necessary rescue funding, Northvolt filed for bankruptcy protection in the United States in November 2024, followed by proceedings in Sweden, marking the end of its journey as an independent European entity.

Latest Developments: Lyten Steps In To Acquire Northvolt

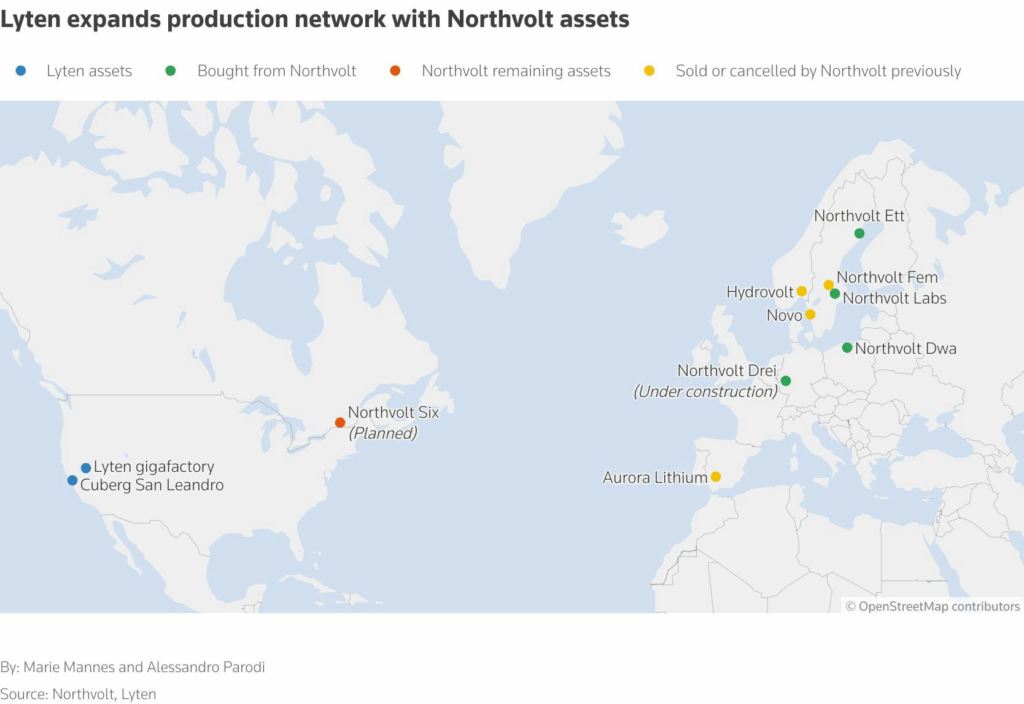

Lyten, a California company specializing in lithium-sulfur batteries, has formally acquired nearly all of Northvolt’s remaining assets in Sweden and Germany. The agreement includes the Northvolt Ett gigafactory, the Northvolt Labs R&D center, and the site for the planned Northvolt Drei factory in Germany. These assets, developed with an investment of around $5 billion, provide Lyten with 16 GWh of operational manufacturing capacity.

This is the latest in a series of acquisitions by Lyten, which previously took over Northvolt’s battery energy storage system (BESS) facility in Poland in July 2025 and its Cuberg lithium-metal battery operation in California in November 2024. The company has stated it will immediately work to restart production at the Swedish sites. The deal itself was made at a “significant discount,” according to Lyten’s CEO, and is financed entirely through private equity investment.

Tech Analysis: A New Technological Direction for Europe

The acquisition represents more than a change of ownership; it introduces a new technological direction for large-scale battery manufacturing in Europe. Lyten’s focus is on lithium-sulfur chemistry, a technology that offers a higher energy density and lower weight compared to conventional lithium-ion cells. A key feature of this technology is its independence from critical minerals like nickel, cobalt, and manganese, which are central to many lithium-ion batteries and have complex supply chains.

Source: Lyten

Lyten’s lithium-sulfur battery technology demonstrates substantial technical maturity in manufacturing and early applications while facing significant commercialization challenges particularly in cycle life performance. The company has successfully transitioned from R&D to pilot production and niche market deployment, positioning it as a leader in next-generation battery technology. The most significant hurdle limiting widespread commercial adoption is, however, limited cycle life of the lithium-sulfur battery technology.

By taking over Northvolt’s advanced, but idle, manufacturing infrastructure, Lyten can sidestep years of construction and development. The plan is to continue producing lithium-ion batteries to honor existing contracts while gradually converting production lines to its lithium-sulfur technology. This strategy allows for business continuity and provides a practical path to introduce a new type of battery to the European market, directly addressing concerns about supply chain security and dependence on foreign material suppliers.

What This Means for Northvolt’s Facilities and Workforce

Lyten’s European expansion leverages the collapse of Northvolt’s ambitious European battery empire, acquiring premium assets at significant discounts. A primary question following the announcement concerns the future of the acquired facilities and the thousands of employees affected by Northvolt’s failure. Lyten has been clear in its intent to preserve jobs, stating plans to rehire a large number of the former workforce. This move is intended to retain the technical expertise and operational knowledge built up at the sites.

Operations at the Northvolt Ett factory and the Northvolt Labs R&D center are expected to restart quickly. For the Northvolt Drei site in Germany, Lyten will continue to work with government partners to move the project forward. The immediate goal is to stabilize the operations and restore manufacturing output, which will be important for the regional economy in Skellefteå, Sweden, a community that had invested heavily in the promise of the gigafactory.

What Lyten will do with the sites and IP

- Sweden: Restart Ett and Labs promptly after close, rehire former staff, and get production back online. The company describes near-term capacity at around 31 GWh tied to Skellefte when including under-construction lines, with room to scale further over time in line with demand.

- Germany: Work with authorities on the Heide projects next steps; timelines will depend on permitting, market conditions, and Lyten’s product roadmap.

- Poland: Integrate Gdask into Lyten’s ESS strategy alongside the BESS portfolio and team acquired in late July to keep delivering to European storage customers.

(Source: PR Release Lyten August 7, 2025; Lyten July 1, 2025; Lyten July 28, 2025)

What Comes Next

The path forward for Lyten involves a dual strategy. In the short term, the company must effectively manage the integration of Northvolt’s assets and workforce, restart production, and manage existing customer relationships. This will test its ability to succeed where Northvolt struggled, turning high-cost facilities into profitable operations.

Longer-term, manufacturing will be transitioned to lithium-sulfur battery production. This shift will require careful engineering and process development to adapt the existing lithium-ion manufacturing lines. The success of this transition could set a new precedent for the industry, potentially accelerating the move away from chemistries that rely on contentious materials. This makes Lyten a company to watch as a potential force in the next phase of battery technology.

Opinion

Lyten’s acquisition of Northvolt’s core European operations is a notable event for the battery industry. It has replaced a struggling European project with an American technology-focused company, potentially swapping or extending a lithium-ion strategy for a lithium-sulfur one. This deal preserves existing manufacturing infrastructure and jobs in Europe while positioning a next-generation battery technology to play a central part in the continent’s ambitions for energy and supply chain security.