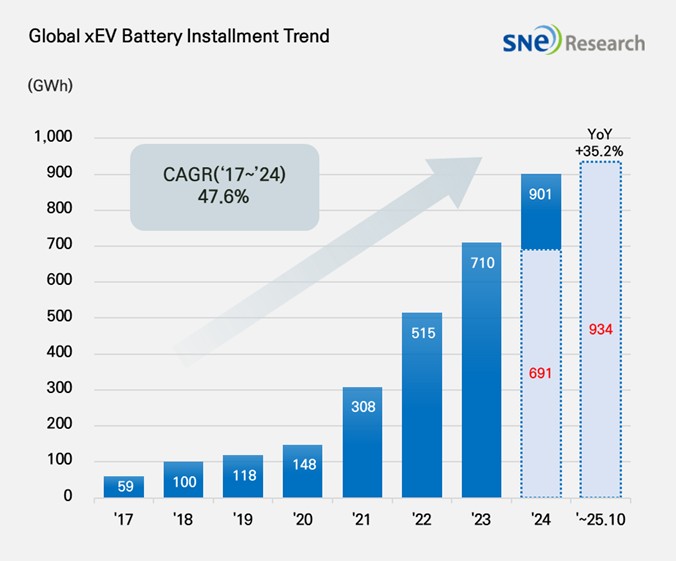

Between January and October 2025, global battery capacity installed in electric vehicles—including BEVs, PHEVs and HEVs—reached approximately 933.5 GWh, marking a 35.2 percent year-on-year increase. During this period, the combined share of three South Korean suppliers—LG Energy Solution, SK On and Samsung SDI—in worldwide EV battery usage totaled 16.0 percent, a decline of 3.5 percentage points compared with the same period in 2024.

LG Energy Solution held the third-largest market share at 12.8 percent, corresponding to 86.5 GWh of battery installations, and recorded year-on-year growth. SK On ranked sixth with 19.3 percent growth to 37.7 GWh. Samsung SDI experienced a 4.6 percent decline in installations, totaling 25.1 GWh.

Samsung SDI supplies batteries to several European and North American manufacturers. Its cells power BMW’s i4, i5, i7 and iX models, which have seen increased sales, and the Audi Q6 e-tron, built on the PPE platform. In the U.S., Rivian’s R1S and R1T adoption slowed after introduction of a standard-range model using lithium-iron-phosphate cells from another supplier, reducing Samsung SDI’s share.

SK On’s batteries are fitted in vehicles from Hyundai Motor Group—including the IONIQ 5 and EV6—Mercedes-Benz, Ford and Volkswagen. Continued demand for VW’s ID.4 and ID.7 models and healthy sales of the Explorer EV helped offset a slowdown in Ford F-150 Lightning production.

LG Energy Solution experienced a drop in volume used by Tesla, contributing to a 14.5 percent year-on-year decrease. However, gains from Kia’s EV3 and expanding sales of Chevrolet’s Equinox, Blazer and Silverado EV under GM’s Ultium platform supported its overall growth.

Panasonic, ranking seventh with 35.9 GWh, has focused on efficiency improvements at its U.S. plants and development of next-generation 4680 and 2170 cells to diversify beyond its longstanding partnership with Tesla.

Leading the market, CATL achieved 36.6 percent growth to 355.2 GWh, supplying brands such as ZEEKR, Li Auto, Xiaomi and major global automakers. BYD claimed second place with 157.9 GWh—a 36.1 percent increase—driven by in-house production of both batteries and vehicles, and a 216.4 percent surge in European battery usage to 11.2 GWh.

As regional policies evolve, automakers in North America are securing long-term battery agreements to stabilize costs, while Europe promotes local assembly and material sourcing. Asian suppliers continue to differentiate with high-energy-density cells, long-life platforms and advanced battery management systems. Beyond 2026, success will depend on strategic, regionally tailored portfolios rather than purely global scale expansion.

Source: SNE Research