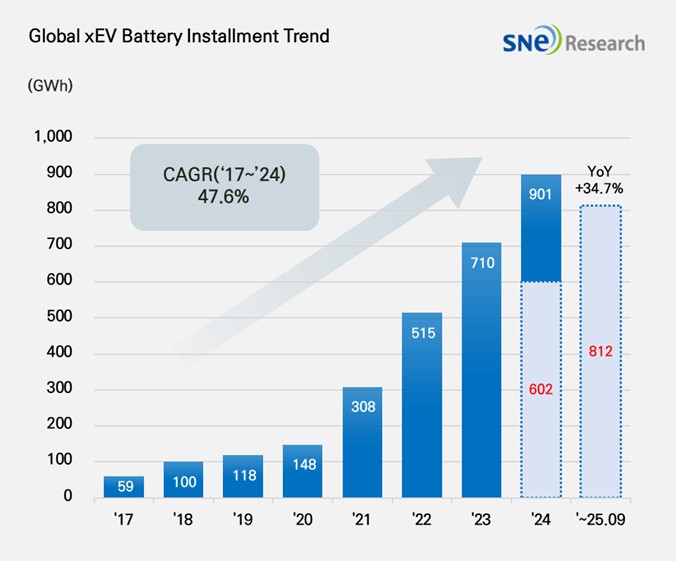

Between January and September 2025, the total installed capacity of batteries for electric vehicles (EVs, PHEVs and HEVs) reached approximately 811.7 GWh worldwide, marking a 34.7% year-over-year increase. This growth reflects sustained demand for electrified powertrains and ongoing expansion of EV production.

Contemporary Amperex Technology Co., Limited (CATL) retained the top spot in global battery usage, accounting for 31.5% of the total (297.2 GWh), driven by partnerships with OEMs such as ZEEKR, AITO, Li Auto, Xiaomi, Tesla, BMW, Mercedes-Benz and Volkswagen. BYD followed in second place with 145.0 GWh of battery capacity, up 45.6% year-on-year. As a fully integrated battery and vehicle manufacturer, BYD leveraged competitive pricing to boost sales across multiple BEV and PHEV models. Its export strategy in Europe was particularly successful, with battery usage in that region jumping 246.2% to 10.3 GWh between January and September.

Among other major suppliers, LG Energy Solution held 14.7% of global EV battery usage (79.7 GWh). While Tesla’s slowdown led to a 14.5% decrease in LG’s battery usage by that OEM, stronger sales of the Kia EV3 and North American demand for Chevrolet’s Equinox, Blazer and Silverado EV models—built on the Ultium platform—supported LG’s volumes. SK On recorded 34.5 GWh in usage (24.0% growth), supplying batteries for Hyundai Motor Group’s IONIQ 5 and EV6, as well as Mercedes-Benz, Ford and Volkswagen models. Sales of the Ford F-150 Lightning slowed, but SK On plans to expand LFP and energy storage system production at its U.S. plants in 2H 2026 to improve operating rates. Samsung SDI’s battery usage declined 4.7% to 23.0 GWh, affected by Rivian’s switch to third-party LFP cells for its standard-range R1 models, offset slightly by a 33.6% increase in Audi Q6 e-tron production. Panasonic, largely a Tesla supplier, reported 33.0 GWh and is reshaping its supply chain for North America by reducing reliance on Chinese materials and securing local sources.

The overall lithium-ion battery market continues to expand, but companies face rising regulatory scrutiny and raw material risks. Initiatives such as potential G7 and EU price caps on rare earths, U.S. efforts to secure lithium supplies, and the localization of Chinese manufacturers in Europe highlight the need for balanced strategies. Going forward, battery producers must pursue technological innovation, material diversification, sustainable design and robust recycling to maintain long-term competitiveness.

Source: SNE Research