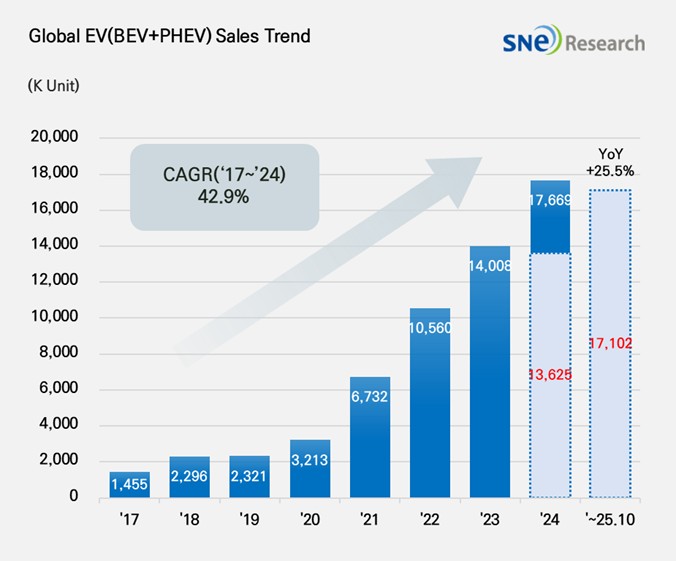

From January to October 2025, approximately 17.102 million electric vehicles (EVs) were delivered worldwide, marking a 25.5% increase over the same period in 2024. China led with 10.894 million units sold, up 24.2% year-over-year, and accounting for 63.7% of the global market. Domestic demand for entry-level passenger models and commercial vehicles has remained stable, while major original equipment manufacturers (OEMs) such as BYD, Geely, and SAIC have expanded exports to Europe and Latin America, supported by vertically integrated local supply chains.

BYD retained its position as the top global EV seller with 3.322 million units, up 4.8% year-over-year. The company has responded to shifts in tariffs and subsidies by establishing production facilities in Hungary, Turkey, Thailand, Indonesia, and Cambodia. BYD has also broadened its lineup from commercial to small passenger vehicles, although it has revised its full-year sales target down to 4.6 million units, reflecting intensified competition among Chinese OEMs.

Geely Group climbed to second place with 1.78 million EVs sold, a 64.7% increase driven by the popularity of its Star Wish model and growth across its ZEEKR, Galaxy, and Lynk & Co brands. Geely’s strategy of vertical integration—developing in-house battery, electrical, and software technologies—along with expanded production capacity, has been identified as a key factor in its competitiveness.

Tesla delivered 1.308 million vehicles, a 7.7% decline compared to the previous year. Slower sales of Model 3 and Model Y led to reductions across its major markets: Europe (-20.5%), China (-8.4%), and North America (-8.4%), the latter partly due to the expiration of consumer tax credits.

Hyundai Motor Group reported steady growth, selling 529,000 EVs globally, a 15.1% increase. Battery-electric models IONIQ 5 and EV 3 drove gains, while smaller models like Casper, EV 5, and Creta Electric performed well. In North America, Hyundai delivered 148,000 units—third behind Tesla and General Motors—despite a 13.0% decline, outperforming Ford, Stellantis, Toyota, and Volkswagen.

Europe recorded 3.357 million EV deliveries (+32.9%), led by mid-size SUVs and crossovers built on common platforms. In North America, 1.55 million units were sold (+4.7%), though monthly sales fell sharply after consumer incentives expired. Outside China, Asia’s EV market grew 56.0% to 973,000 units, driven by small, affordable models in India and expanding local manufacturing in Southeast Asia.

In late 2025, the European Union and China agreed to replace planned additional tariffs on Chinese EVs with transitional tariffs through 2029. In China, NEVs surpassed internal combustion engine vehicle sales for the first time in October, reaching 51.6% of wholesale vehicle sales. Policymakers in China are balancing stimulus measures, subsidy adjustments, and regulations aimed at sustaining NEV growth and supporting economic recovery, with implications for global pricing, supply chains, and trade dynamics.

Source: SNE Research