According to BloombergNEF’s Levelized Cost of Electricity 2026 report, battery storage costs reached record lows in 2025 even as most other clean power technologies became more expensive. The global benchmark cost for a four-hour battery storage project fell 27% year-on-year to $78 per megawatt-hour (MWh), the lowest level recorded since BNEF began tracking costs in 2009. Key factors driving this decline included reductions in battery pack prices, heightened competition among manufacturers and advances in system design. In addition, developers commissioned 87 gigawatts of co-located solar and storage capacity in 2025, delivering power at an average cost of $57/MWh.

By contrast, the global benchmark levelized cost of electricity (LCOE) for fixed-axis solar farms rose 6% to $39/MWh, onshore wind increased to $40/MWh and offshore wind climbed to $100/MWh, reversing recent downward trends. Supply-chain constraints, lower resource availability and regulatory changes in mainland China contributed to these cost increases.

BloombergNEF projects that continued innovation and competition will drive further declines in clean-energy technology costs through 2035. Its forecasts call for LCOE reductions of roughly 30% for solar, 25% for battery storage, 23% for onshore wind and 20% for offshore wind over that period.

Thermal power generation also saw higher costs in 2025. New combined-cycle gas turbine costs increased 16% to $102/MWh, driven by rising equipment prices and sustained demand from data-center development.

Regional dynamics played a role in wind project costs, with mainland China maintaining a cost advantage. Outside China, onshore wind costs fell 4%, but the global benchmark edged up 2% as recent Chinese projects were built in lower-resource areas. Offshore wind costs rose 12% globally, with the United Kingdom experiencing a 69% increase in recently financed projects compared with five years ago.

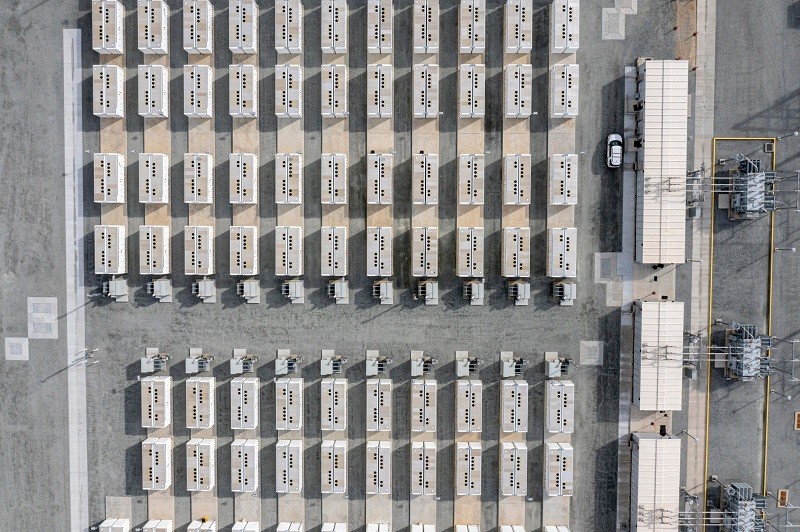

In the United States, onshore wind regained its status as the cheapest option for new electricity generation, overtaking gas-fired power for the first time since 2023. Developers in regions such as California and Texas are increasingly favoring co-located solar and battery systems over gas turbines to meet data-center demand at lower cost. These trends highlight how falling storage costs and rising gas prices are strengthening the economics of renewables and supporting a shift toward storage-led system balancing.

Source: BloombergNEF