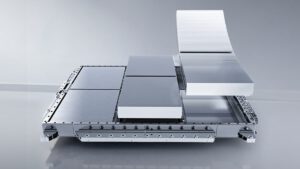

Lithium prices in China jumped sharply on Monday following an announcement by Beijing that it will phase out value-added tax export rebates on battery products. Market participants interpreted the policy change as a trigger for exporters to accelerate shipments before rebates are reduced and then fully removed.

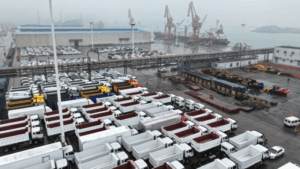

On the Guangzhou Futures Exchange, the most-active lithium carbonate contract closed at 156,060 yuan per metric ton, up 9%—its daily trading limit and the highest level since November 2023. Traders and analysts say the prospect of lower export incentives is prompting battery manufacturers to front-load overseas sales in the coming months.

China’s finance ministry said on Friday that the VAT rebate on exported battery products will be cut from 9% to 6% starting April 1, and will be eliminated entirely on January 1, 2027. Although the rebate applies to finished battery exports rather than lithium carbonate itself, analysts at Orient Securities note that any surge in battery production and shipments ahead of the deadline is likely to drive up lithium demand in the near term.

Since mid-2025, lithium prices in China have climbed steadily, rising 167% from last year’s lows. Observers point to Beijing’s efforts to curb overcapacity in the lithium sector, as well as the temporary halt of production at a major mine operated by one of the country’s top battery firms, as factors supporting higher prices. In addition, robust demand for lithium in energy storage systems continues to underpin tight market conditions.

Looking ahead, the removal of export rebates may temper battery export growth over the longer term, aligning with government goals to reduce excessive competition and encourage domestic value-added activities. In the short term, however, market sources expect lithium and battery prices to remain firm as exporters pull forward shipments to lock in current rebate levels.

Source: Reuters