Supply constraints stemming from export restrictions in the Democratic Republic of the Congo (DRC) have driven the global cobalt market from oversupply in early 2025 to a projected deficit in 2026, according to Fastmarkets analysts. Following the DRC’s February 2025 ban and subsequent quota system, cobalt metal prices more than doubled last year, while cobalt hydroxide feedstock costs climbed over fourfold.

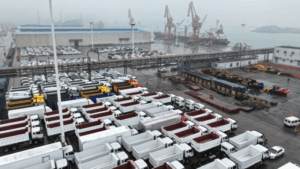

China emerged as the primary cobalt metal supplier in 2025, leveraging its extensive refining capacity and downstream supply chain for electric vehicles and electronics. Exports from China to Europe reached 5,147 tonnes via Rotterdam in 2024—a 153% increase—temporarily easing prices. However, by mid-2025, dwindling hydroxide availability and production cuts within China led to tighter domestic supply and higher in-country prices.

Although DRC exports have been technically permitted under a quota framework since October 2025, administrative hurdles—including royalty prepayment requirements and pilot shipments—have kept most material on hold. A small backlog of 18,125 tonnes from late 2025 may be cleared in the first half of 2026, but overall exports are capped at 87,000 tonnes annually through 2027. In addition, the DRC plans to build a strategic stockpile of 9,600 tonnes per year for domestic projects.

Faced with constrained DRC volumes, battery and materials consumers have accelerated interest in alternative feedstocks such as mixed hydroxide precipitate (MHP) from Indonesia and black mass recovered through battery recycling. Fastmarkets projects Indonesian cobalt-in-MHP production to reach roughly 67,500 tonnes in 2026—a 145% increase from 2025—yet still insufficient to offset the DRC shortfall. Recycled cobalt payables climbed to 88–100% of benchmark prices by year-end 2025, up from about 70% earlier in the year.

Fastmarkets forecasts a 2026 market deficit of 10,700 tonnes against demand of 292,300 tonnes. Potential easing could arrive in Q2 2026 if delayed DRC quotas and stockpile volumes are released. Meanwhile, demand remains robust in aerospace, medical and defense segments, and US stockpiling has bolstered market sentiment. Growing investment in recycled metal and strategic quota adjustments will be key factors shaping cobalt dynamics over the next year.

Source: Fastmarkets