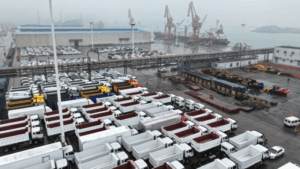

The Democratic Republic of Congo (DRC) has announced new export quotas for cobalt, aiming to stabilize global supply and encourage domestic processing. Effective October 16, the country will allow up to 18,125 tonnes of cobalt to leave its ports before the end of 2025. The current export suspension will remain in place until October 15, following a decision by the Regulatory and Control Authority for Strategic Mineral Substances (ARECOMS).

According to ARECOMS Chairman Patrick Mpoyi Luabeya, the quota system is intended to “rebalance the market over the coming months and in the years ahead.” Global cobalt stocks have already declined sharply under the suspension, and these measures are viewed as a middle ground between a full ban and unrestricted exports.

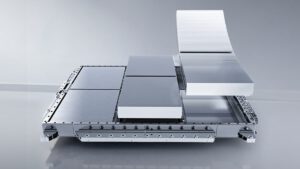

Looking ahead, the DRC has outlined annual quotas of 87,000 tonnes for both 2026 and 2027, equating to 7,250 tonnes per month—approximately half the average monthly exports recorded in 2024. In addition to the base allocation, a strategic quota of 9,600 tonnes has been set aside for projects deemed nationally significant, with ARECOMS retaining sole discretion over these volumes.

The authority also reserves the right to adjust quotas quarterly if market imbalances occur and to revise the 2027 allocations based on evolving market conditions and progress toward local processing of higher-value products. This policy supports the DRC’s long-standing objective to expand domestic refining capacity and capture more value within the country.

Market participants have generally welcomed the clarity provided by the quotas. Some analysts anticipate that limiting shipments to 7,250 tonnes per month may curb excess metal production in key consuming countries while ensuring a steady flow of cobalt sulfate and oxide. Others noted that the October export, capped at 3,625 tonnes, will likely reach Asian markets by January, given typical shipping lead times.

By curbing surplus stocks and aligning exports with strategic national priorities, the DRC’s quota framework could help prevent price volatility and reinforce the country’s leverage in the cobalt market.

Source: Fastmarkets