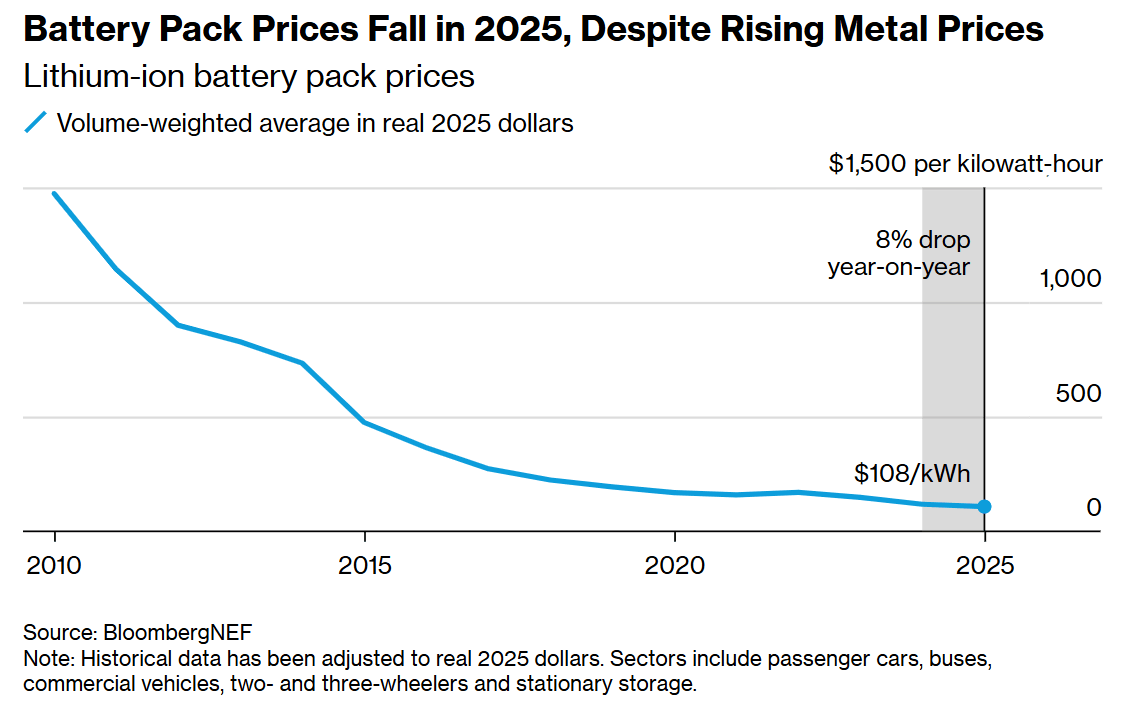

Global lithium-ion battery prices continued their downward trajectory in 2025, with average pack costs falling 8% to $108 per kilowatt-hour, according to BloombergNEF’s annual survey. In real terms, this represents a 93% decline since 2010, reflecting sustained innovation and efficiency gains across the value chain.

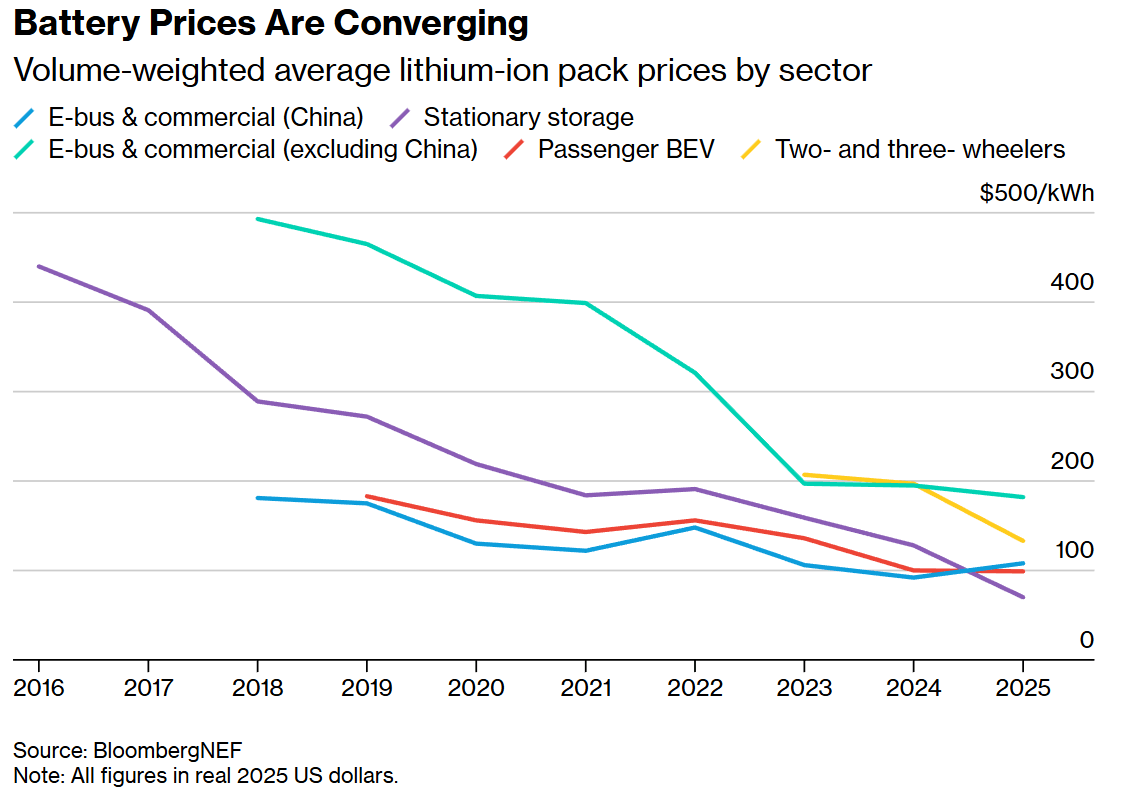

China maintained its lead in low-cost batteries, with average prices dropping 13% to $84/kWh. Factors driving this include reduced input costs, production overcapacity, aggressive price competition and a strong shift toward lithium iron phosphate (LFP) chemistries. In contrast, North American and European prices remained 44% and 56% higher, respectively, which helps explain why electric vehicles in those markets generally carry a premium over combustion-engine models. In China, most EV segments have already reached price parity with their gasoline counterparts.

The lowest cell and pack prices observed were $36/kWh and $50/kWh, respectively, for LFP systems deployed in stationary storage. Comparable lows were recorded in 2024, suggesting these figures are becoming industry benchmarks rather than statistical outliers.

Despite a sharp rise in cobalt prices—prompted by export quotas from the Democratic Republic of the Congo—and modest increases in lithium costs, overall battery prices held steady. Industry participants have offset material cost pressures through broader adoption of LFP, long-term supply contracts and expanded commodity hedging strategies. This resilience contrasts with earlier years, when reliance on nickel manganese cobalt cathodes directly translated metal-price spikes into higher battery costs.

Diversification within the battery sector is accelerating, with sodium-ion production facilities coming online and novel cathode and anode chemistries edging toward commercialization.

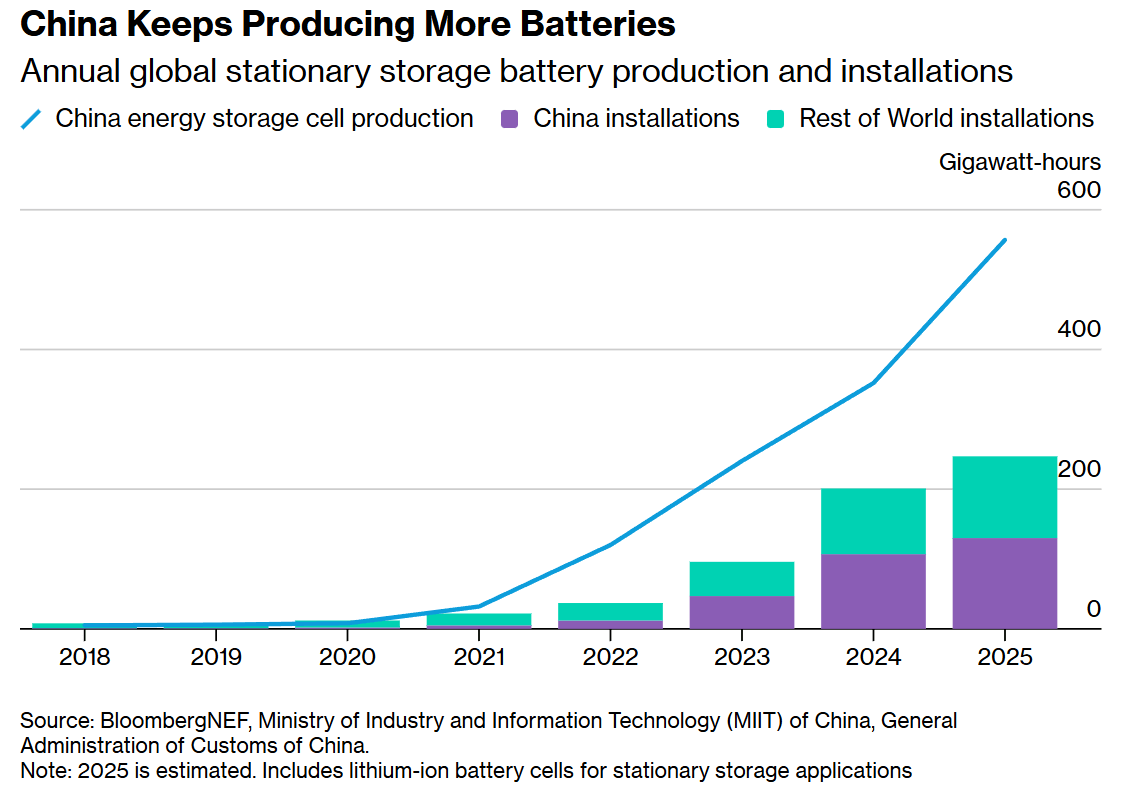

In stationary storage, pack prices plunged 45% year-over-year to an average of $70/kWh, making it the most affordable segment for the first time. This decline is largely driven by intense competition in China, where an estimated 557 GWh of stationary storage cells were produced in 2025—more than twice the volume of global installations. As costs fall, applications from EV charging stations to data centers and commercial demand-management systems are expected to expand rapidly.

EV battery pack costs remained below the $100/kWh threshold for a second consecutive year, with average cell-only prices at $79/kWh. Western automakers’ recent introduction of LFP in entry-level models should push global averages even lower. Prices for two- and three-wheeled vehicles also dipped to $133/kWh amid rising demand in India and Southeast Asia.

This annual analysis underscores the battery industry’s advancing cost competitiveness and its growing ability to absorb material-price volatility.

Source: BloombergNEF