India is rapidly expanding its battery manufacturing sector under its national industrial strategy, with more than 30 gigafactories expected to be operational by 2030 and a combined target production capacity exceeding 290 gigawatt-hours (GWh). These facilities are planned to support a wide range of applications, from battery-electric vehicles (BEVs) and battery energy storage systems (BESS) to renewable energy storage, industrial power plants, telecommunications sites and data centers. Approximately 30 percent of the capacity is earmarked for electric mobility.

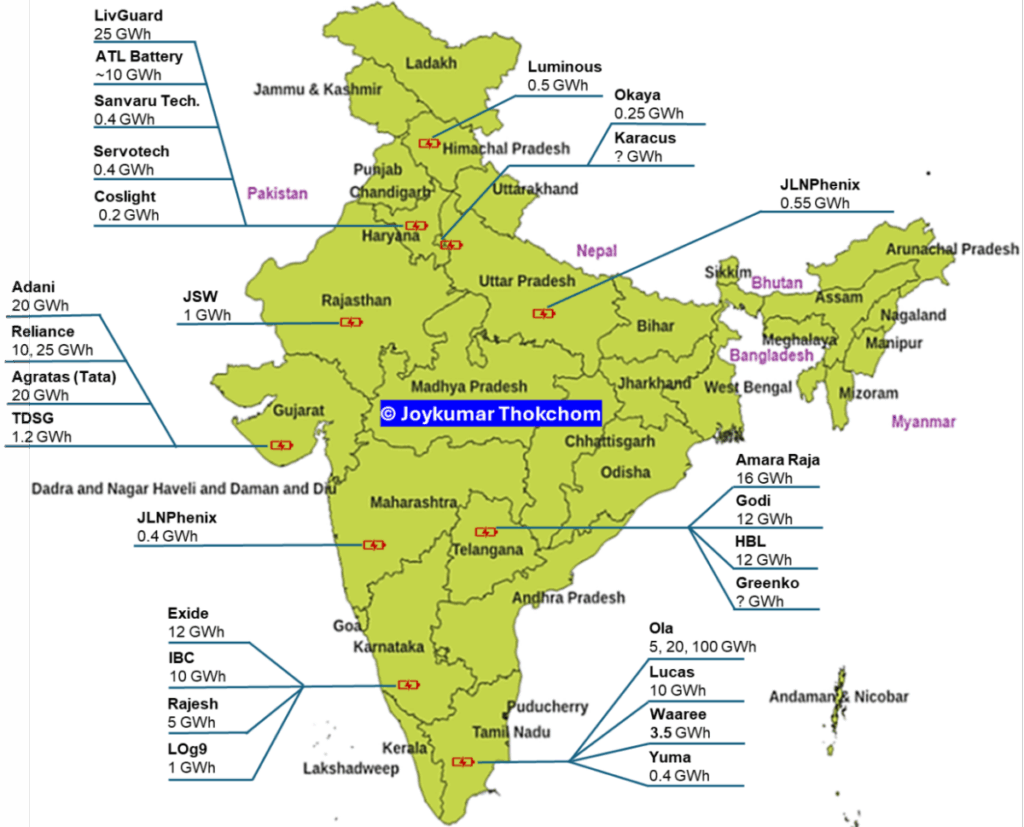

Major domestic players have announced gigawatt-scale projects across key states. Adani Power and Tata’s Agratas Energy each plan 20 GWh plants in Gujarat, while Amara Raja and Exide Industries aim for 16 GWh and 12 GWh facilities in Telangana and Karnataka, respectively. Other significant investments include Godi Energy’s 12.5 GWh and HBL Power Systems’ 12 GWh plans in Telangana, LivGuard Energy’s 25 GWh plant in Haryana, and Reliance Industries’ 25 GWh project in Gujarat. International Battery Co., Lucas TVS, Ola Electric and several other firms have also announced gigafactory proposals targeting lithium-ion chemistries such as lithium iron phosphate (LFP), nickel manganese cobalt (NMC) and semi-solid.

Despite these announcements, actual operational capacity remains limited, with just over 1 GWh online as of late 2025—around 2.8 percent of the government’s 50 GWh target for that year. Delays stem from raw-material shortages, supply-chain complexity and a shortage of skilled labor. India currently depends on imports of key cathode and electrolyte materials, including lithium salts like LiPF6, while domestic R&D funding and long-term strategic planning are still developing.

India’s strengths include a large pool of educated young workers, an existing electronics and software ecosystem—especially in battery management systems—and growing recycling infrastructure near port cities. The country also produces non-chemical components such as current collectors, separators, solvents and packaging. Achieving full supply-chain autonomy will require scaling up domestic production of critical materials and further investment in R&D.

As India pursues goals such as 100 percent electrified transportation by 2035 and 500 GW of renewable energy by 2030, the battery gigafactory rollout will play a central role in supporting the nation’s transition toward net-zero emissions and energy security.

Source: pv magazine India