South Korea’s L&F has reduced the value of its cathode material supply agreement with Tesla to approximately $7.4 million, reflecting a significant adjustment compared to the originally announced contract size.

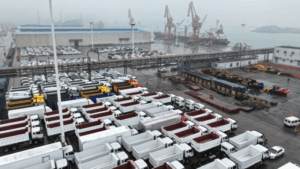

South Korea’s L&F finalized its 2023 supply deal with Tesla following a regulatory filing that attributed the adjustment to schedule shifts amid changes in the global EV market and the battery supply environment.

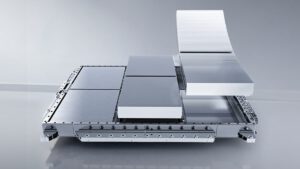

The change has drawn attention across the battery and electric vehicle industry, as L&F is considered a key supplier of high-nickel cathode materials for next-generation lithium-ion battery cells.

Market analysts have pointed to broader uncertainties in EV demand, evolving production timelines, and ongoing changes in battery manufacturing strategies as contributing context for the adjustment, although no specific technical causes were cited by the company in its public disclosures.

L&F continues to invest in advanced cathode materials and remains focused on supporting its global customers as the EV market develops.

Source: Reuters