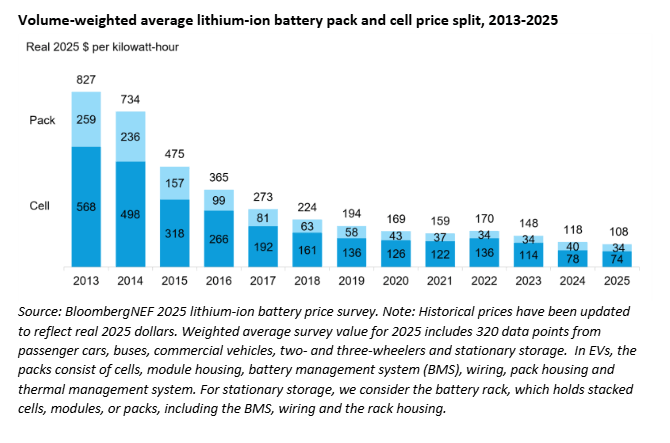

New York – December 9, 2025 – According to BloombergNEF’s 2025 Lithium-Ion Battery Price Survey, average pack prices have fallen to a record low of $108 per kilowatt-hour, marking an 8% decline from 2024 despite higher costs for key battery metals. Industry analysts attribute the drop to sustained overcapacity in cell production, intense competition, and the growing adoption of lower-cost lithium iron phosphate (LFP) chemistries.

Metal prices rose this year due to supply concerns at some Chinese lithium operations and new cobalt export quotas in the Democratic Republic of Congo. Yet manufacturers largely absorbed these increases by shifting to LFP, securing long-term contracts, and broadening hedging strategies, preventing material pass-through to end users.

China’s surplus cell capacity has fueled fierce competition, especially in the stationary storage sector where multiple suppliers compete for the same projects. The country’s leadership in LFP production now meets nearly all global demand for that chemistry.

By application, battery pack costs for stationary storage plunged 45% year-on-year to $70/kWh in 2025—the steepest decline across all segments—making it the most affordable category for the first time.

In the electric vehicle market, battery packs averaged $99/kWh, remaining below the $100 threshold for a second consecutive year. Across all uses, LFP pack prices averaged $81/kWh, while nickel manganese cobalt (NMC) packs averaged $128/kWh.

Regionally, China reported the lowest average pack price at $84/kWh. North America and Europe posted prices 44% and 56% higher, respectively, reflecting higher local production costs and a greater reliance on imports. China also recorded the largest real-terms price decline—13% from 2024—compared with declines of 4% in North America and 8% in Europe. Policy shifts and tariffs in the U.S. prompted Chinese producers to offer more aggressive pricing in Europe, intensifying competition there.

BloombergNEF expects further price reductions in 2026 as LFP adoption expands and investments in R&D, manufacturing efficiency, and supply chain development continue. Emerging technologies—including silicon and lithium-metal anodes, solid-state electrolytes, and new cathode materials—are poised to drive the next wave of cost improvements.

Source: BloombergNEF