US battery production costs could potentially become lower than China’s by the end of the decade when factoring in tax credits from the Inflation Reduction Act (IRA), according to Benchmark’s analysis. The IRA, passed in August 2022, has significantly transformed the US battery sector, positioning domestic producers as potentially the most cost-effective globally.

“The Inflation Reduction Act has truly been transformational in this space,” said Shivangee Chauhan, an analyst at Benchmark. “Suddenly, US producers are the cheapest producers in the entire world.”

The IRA offers a manufacturing production tax credit of $35 per kilowatt-hour (kWh) of cell production for batteries produced in the US, available until 2029. This incentive has spurred a surge of investments in the battery sector. Benchmark’s Lithium-ion Battery Cell Cost Forecast indicates that the average production cost at the cell level in the US could decrease from $111.8/kWh to $76.8/kWh by 2029 when these tax credits are applied. This reduction would make American gigafactories the lowest-cost operations globally.

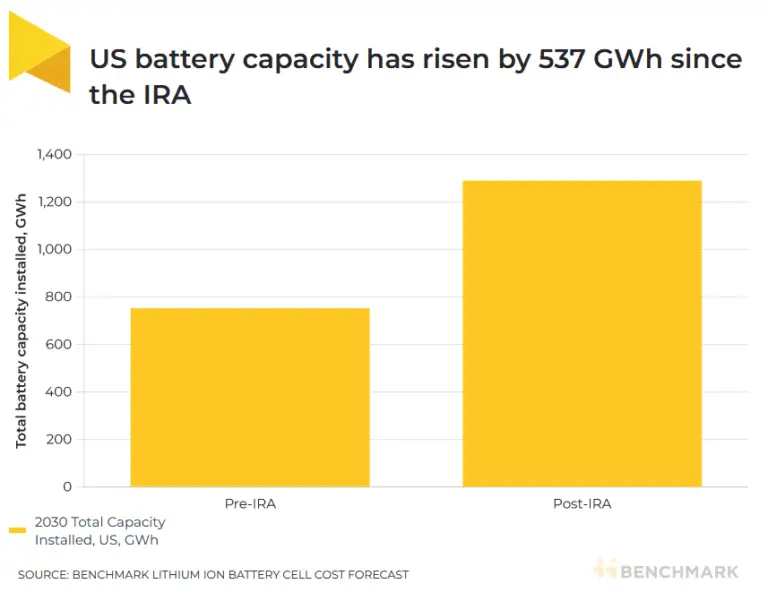

A total of 23 new gigafactories have been added to the development pipeline since August 2022, bringing the total number of planned facilities in the US to 40, according to Benchmark’s Gigafactory Assessment. The total planned capacity for 2030 has risen by 537.0 GWh to 1,290.6 GWh.

Currently, China holds a cost advantage over the US. The average production cost at the cell level for nickel cobalt manganese (NCM) chemistries in China is $95.81/kWh, compared to $98.06/kWh in the US without considering the tax credits.

Boost to Profits

The IRA is enhancing the economics of producing batteries in the US, which is expected to sustain investment momentum. As production capacity comes online, operational improvements are anticipated to further lower costs, according to Chauhan.

Earlier this year, Korean battery producer LG Energy Solution reported that IRA tax credits turned its operating income from a loss of 253 billion KRW to a profit of 195 billion KRW in the second quarter. Panasonic Energy also stated that the tax credits would increase its earnings margin from 7% to 18% for the fiscal year ending in 2024.

Production Challenges

Future battery production in the US is contingent on rising demand for electric vehicles (EVs). However, US automakers have scaled back their EV production plans this year, introducing uncertainty for battery producers.

LG Energy Solution announced it is slowing investment in a planned third plant with General Motors, part of their Ultium Cells joint venture. The company also reduced its forecast for battery production capacity eligible for the IRA tax credit from 45–50 GWh to 30–35 GWh this year, citing “adjustments in ramp-up speed in response to changing customer demands.” Additionally, GM stated it would not have the capacity to produce 1 million EVs next year, as initially targeted.

According to Benchmark’s Gigafactory Assessment, of North America’s 413 GWh of planned battery capacity under construction, over one-third has yet to break ground, with only preliminary site work ongoing. In comparison, only 14% of China’s planned battery plants are in a similar stage. Moreover, the average construction time for plants in North America is almost 30 months, compared to just over 20 months in China.

Source: Benchmark Mineral Intelligence